Speed up cash application with accounts receivable automation.

Instantly and accurately apply customer payments to invoices and reduce unapplied cash.

A Cash Application Portal for Everyone

Benefits

- Synchronization of open invoice data from your ERP system to facilitate application of cash.

- Use of various AI models to extract remittance information

- Automatic import of bank statement BAI2 files

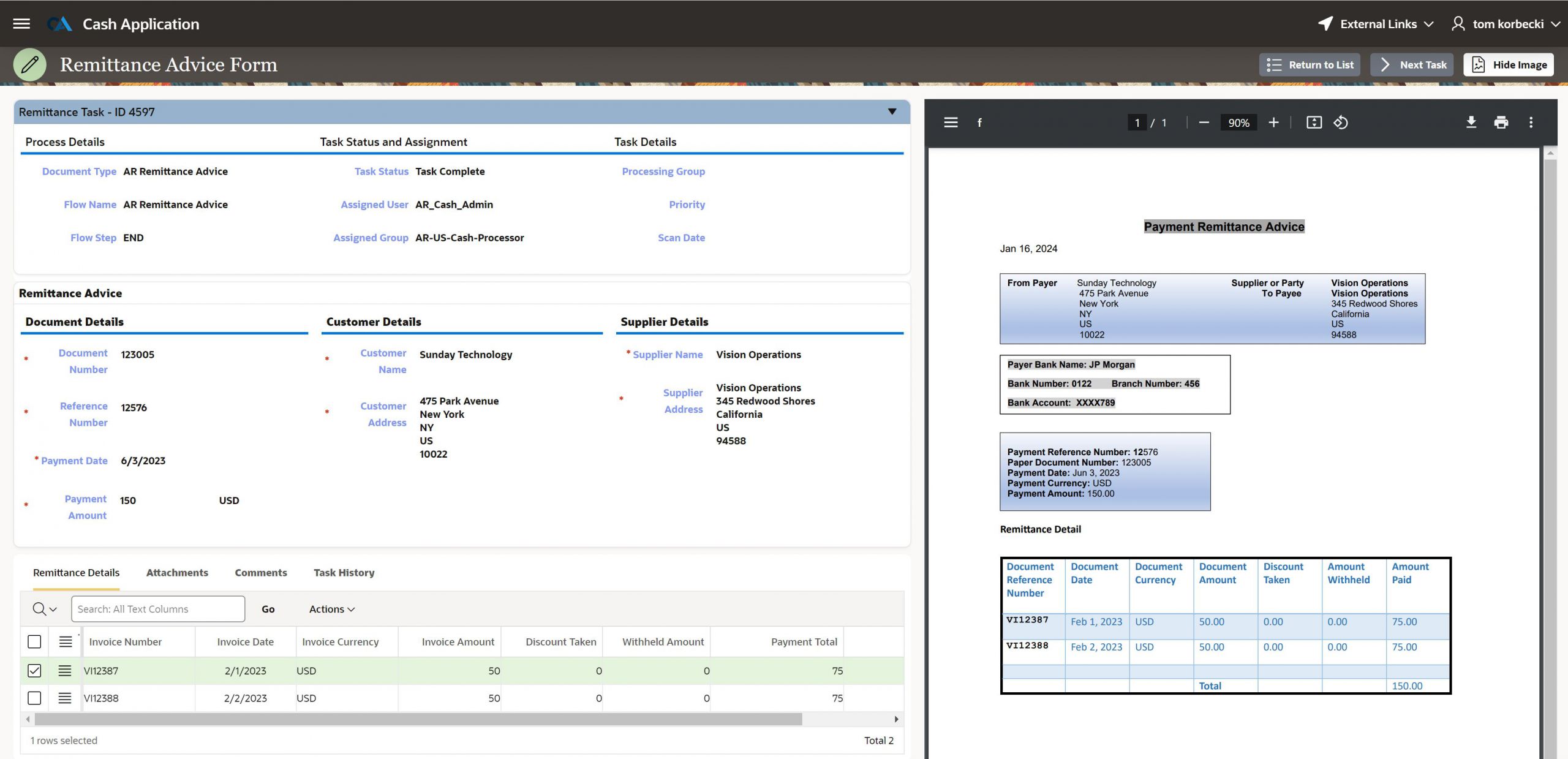

- Data visualization aids to identify the physical position of your extracted remittance data

- Proprietary OAN Learning ™ – Automated cash receipt algorithms

- Ability to prioritize incoming documents for processing

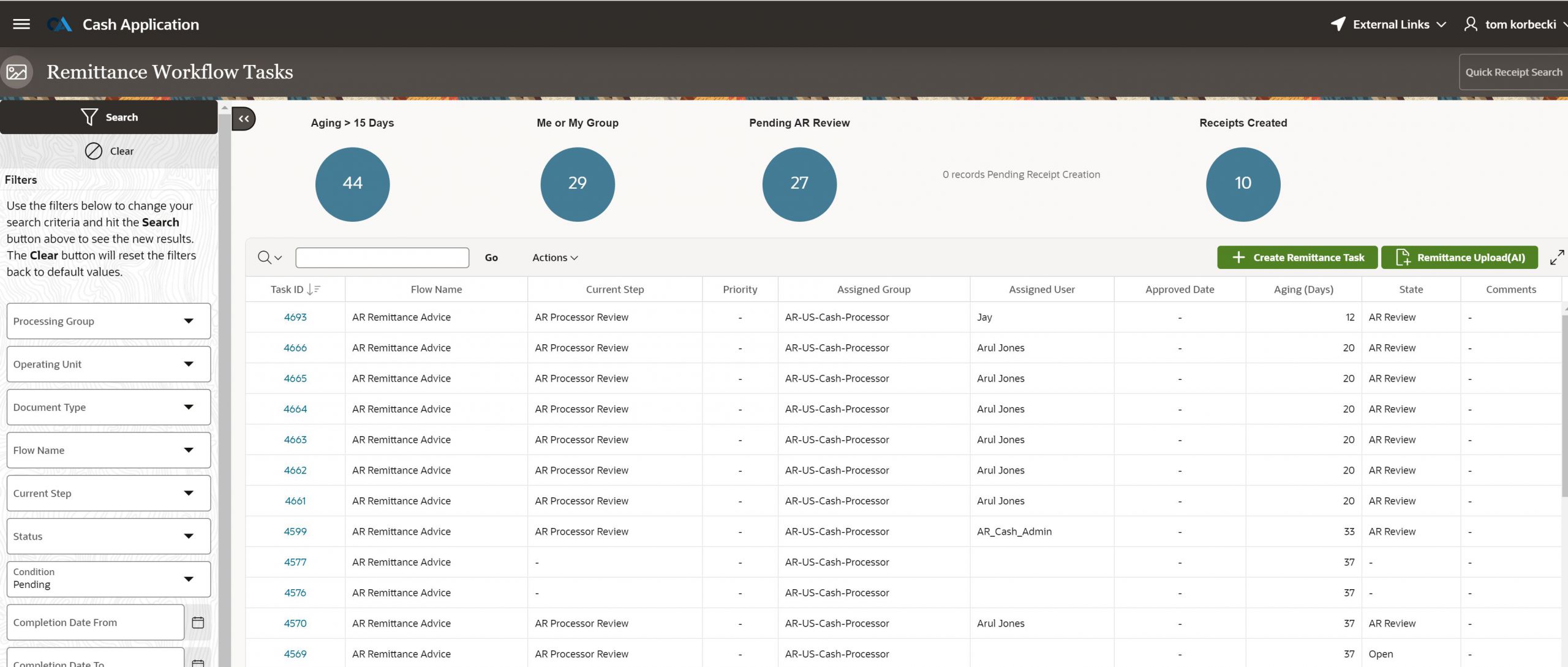

- Pre-Built Workflow to account for human in the loop and exceptions

- Human touch point screens to search and apply receipt(s) to specific invoices, create receipt write-offs, invoice adjustments without chargebacks and invoice adjustments with chargebacks – all from a single screen.

- Pre-built connector to Oracle ERPS to create applied cash receipts.

- Ability to store and retrieve cash application related documents from our content repository system called OAN Business Docs ™, Oracle’s WebCenter content repository or natively within your Oracle ERP system

OAN Cash Application improves the invoice-to-cash cycle by reducing the time needed to apply payments. When a customer payment is received, OAN Cash Application utilizes OAN Learning(TM) to accurately apply the payment to customer invoices in your ERP.

Leverage OAN Cash Application automation to eliminate manual accounts receivable processes, gain visibility and control, and achieve the most efficient orchestration of your invoice-to-cash process.

OAN Removes the Guesswork

Enable finance and accounting teams to focus on more strategic activities by reducing manual inefficiencies and automating reconciliation processes. Account Reconciliations provides accountants with an intuitive interface that includes standardized templates, workflows for preparation, approval, and review, linkage to policies and procedures, and integrated storage of supporting documentation.

OAN Remittance Management

The Remittance process is a slow, labor-intensive, and repetitive process that can consume significant resources. With OAN Cash Application, users benefit from our OAN Learning(TM) platform. This means documents are captured, auto-matching process, and orchestrated into your ERP while capturing all the steps and human actions to support a full internal audit.

OAN Platform – Quick Ramp up Time

Our Pre-built payment application rules were developed from our years of ERP experience and from our vast industry specific knowledge. Our OAN platform, combined with our ability to seamlessly integrate with your ERP systems, enables our Cash Application customers to achieve an enterprise level auto-matching rates that you expect from our software.

Cash Receipt Processing

People

- Reduced time for Receivables teams to enter and apply cash, enabling them to focus on other critical customer-facing activities.

- Reduced time for Treasury teams reconciling cash with bank statements.

- Receivables teams can easily troubleshoot cash receipt data before sending the data to ERP.

- Ability for team members to create invoice or receipt adjustments at the time of cash application and create chargebacks as required for unauthorized deductions.

- Teams can greatly reduce unapplied cash and accurately reflect customer open balances in the ERP.

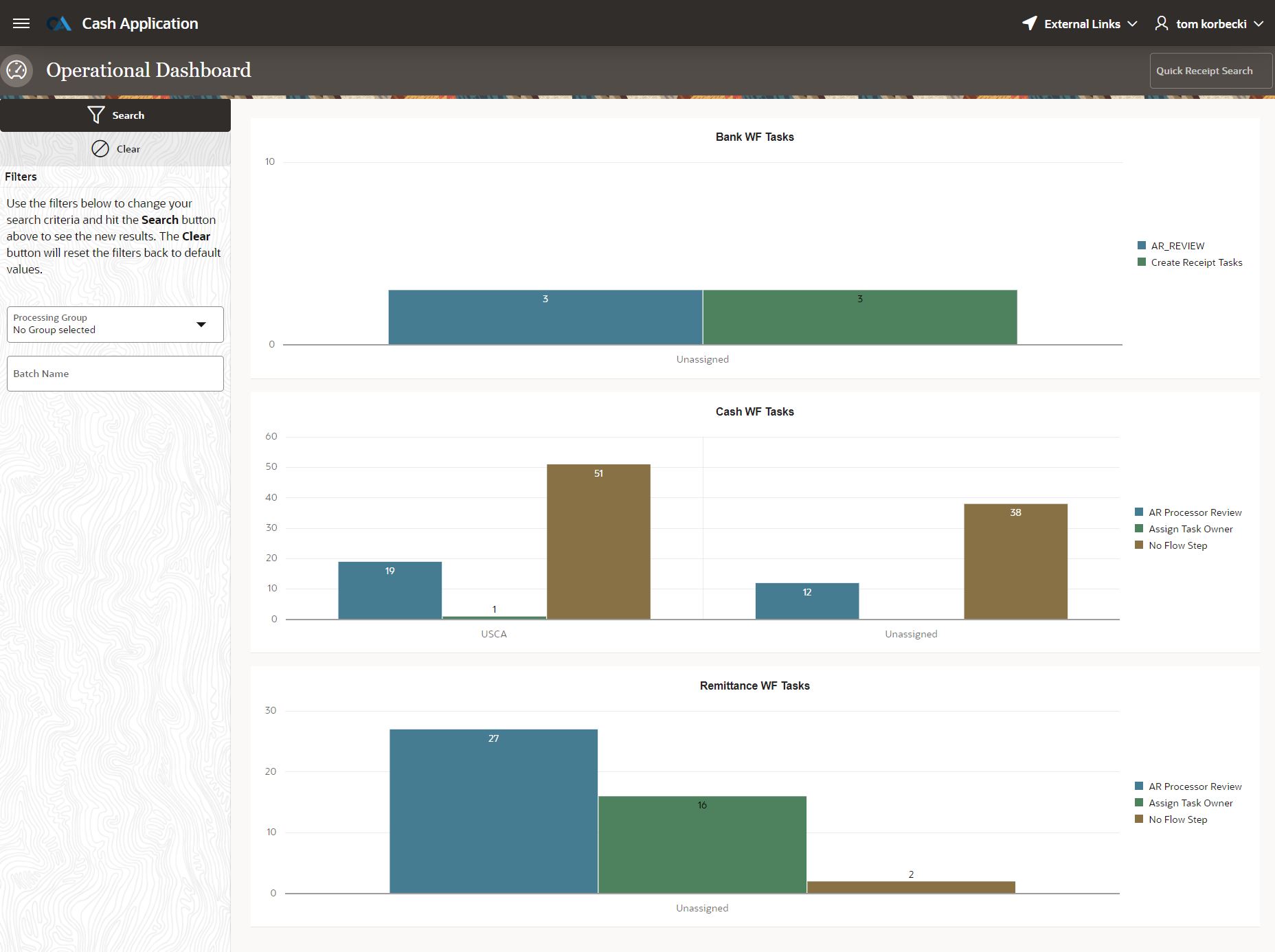

- Enables Receivables Managers to identify bottlenecks and spot process improvements.

The cycle continues with People using these improvements to improve the overall Process!

Process

- Bank statement files, remittance advice documents are guided through a standard set of workflows, steps, statuses, and actions which ensure the documents are fully prepared for the final destination…the ERP system.

- Workflows are fully configurable to meet your specific business needs

Standard and custom business rules are applied to keep the documents on the right track. - Status summary dashboards bring visibility to process trends and bottlenecks.

- The portal unifies Cash Application in a single global process which can be used across multiple shared service centers and ERP systems.

- Audit and Compliance support is provided via Recorded Event History throughout the entire Cash Application process (Bank Statements to Cash Receipts and Post Import into ERP)

The process cannot be made a reality without the use of technology …

Technology

- Provides user interface which is pleasant and easy to use.

- Platform to efficiently gather the information needed to process cash

- Tightly integrates with the ERP system.

- Utilization of ERP setups and configurations to apply specific business rules/validations.

- Seamless interface process into the ERP system

- Apply AI and business logic to:

- Automate the derivation of data.

- Automate the triggering of flow actions.

- Identify exceptions.

- Real-time metrics

- Easily integrates with existing User Security software.

- Integration with common User Security platforms.

- Role-Based Security by Shared Service Center.